|

|

|||||||

| Coffee Shop Talk of a non sexual Nature Visit Sam's Alfresco Heaven. Singapore's best Alfresco Coffee Experience! If you're up to your ears with all this Sex Talk and would like to take a break from it all to discuss other interesting aspects of life in Singapore, pop over and join in the fun. |

|

|

|

Thread Tools |

|

#1

|

|||

|

|||

|

An honorable member of the Coffee Shop Has Just Posted the Following:

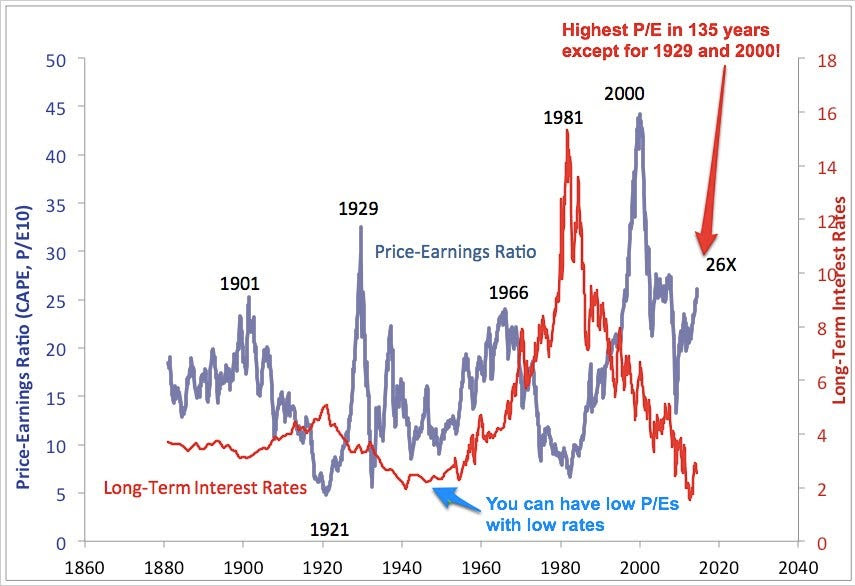

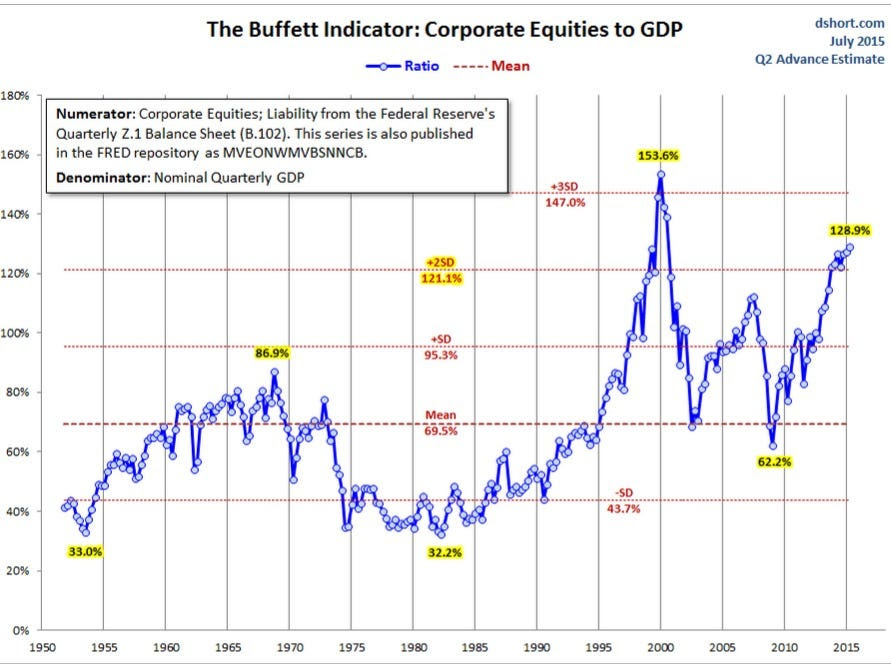

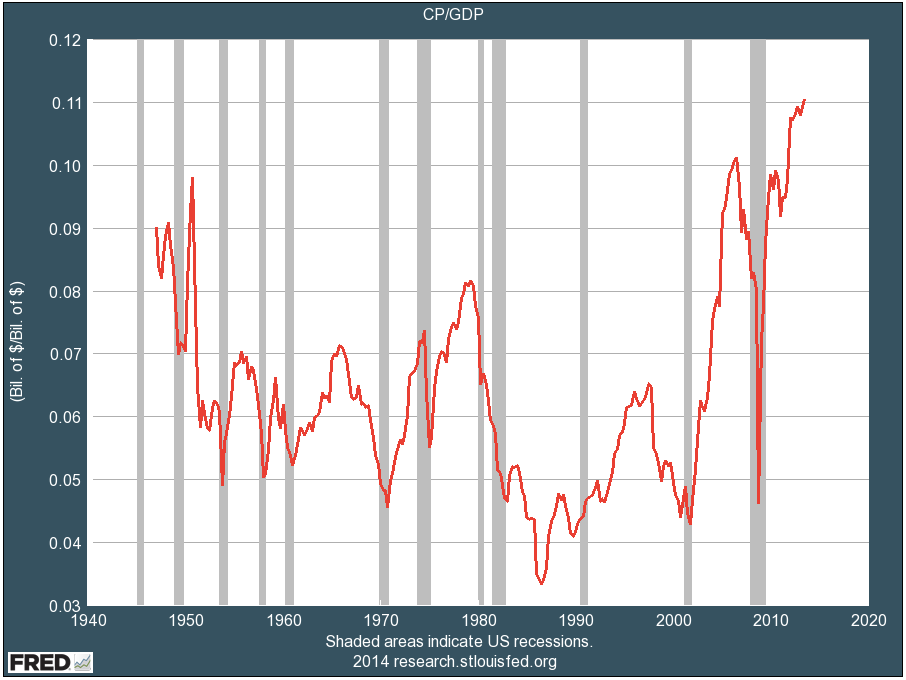

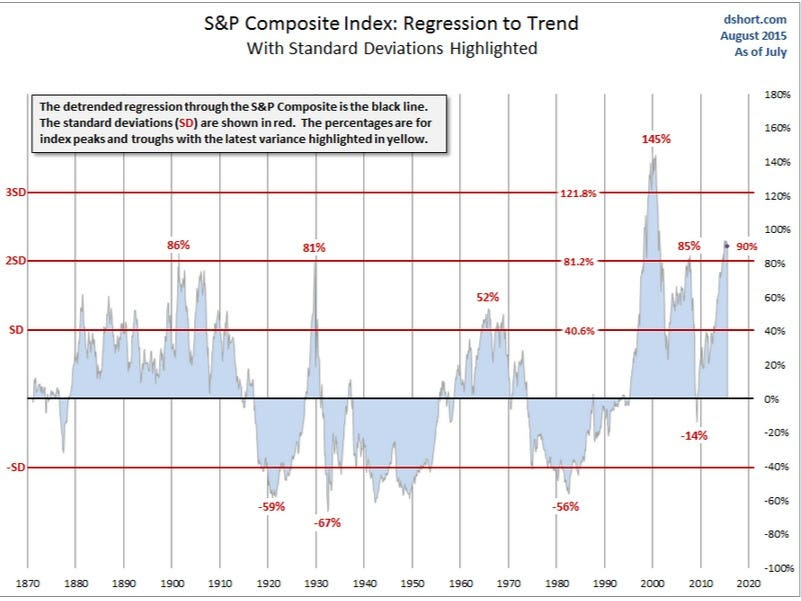

It's time to revisit the disaster scenario for stock prices... The stock-market tumble of the last week has reminded everyone that stock prices also go down. So this seems a good time to remind everyone that stock prices could go down a lot further. And that, in fact, stock prices have to go down a lot further — or, at least, have to stay generally flat for a very long time — just to get back to historically average levels of valuation and performance. Specifically... Today's stock prices are so extreme that a drop of 40%-50% from the recent high would not be a surprise. Indeed, it would take a drop of this magnitude just to get back to average long-term valuation levels, let alone cheap. Meanwhile, after 7 years of frantically pumping money into the financial system, the Fed is not only still going full bore (interest rates are zero) but facing ever-increasing pressure to ease off the gas. So if stock prices do drop sharply, it doesn't seem likely that the Fed will be able to do much to help. They just don't have any ammo or political capital left. Meanwhile, corporate profit margins are still close to all-time highs, wages are still at all-time lows, and average American consumers still have debt coming out of their ears. So it seems likely that, at some point, profit margins will decline, wages will rise (we can only hope), and average American consumers will continue to rein in spending — none of which will boost further profit growth. Meanwhile, interest rates are still at all-time lows. So if and when the economy does finally gather a sustainable head of steam, interest rates will likely rise. And rising interest rates don't tend to be helpful to stock prices. So that's one scenario for stock prices over the next several years: Stock valuations revert toward long-term averages The Fed eases off the gas Corporate profit margins revert toward their long-term averages (hopefully because companies finally start to share some of the wealth they create with the people who create it) Consumers continue to save money and work off debt Interest rates rise If any of those things happen, stock performance will likely be poor for many years. But that's not the disaster scenario. That actually seems like a perfectly reasonable scenario. The disaster scenario is that some or all of these measures do not just revert toward their long-term averages but instead revert beyond them — the way they almost always have before. This mean-reversion would take stock prices more than 50% below the recent high and keep them there for an extended period. If we go from a multi-decade era with spectacularly high stock prices, spectacularly low interest rates, spectacularly high profit margins, and spectacularly stimulative Fed policy to an era characterized by the opposite (like the 1970s), the sharp crashes and relatively quick recoveries of 2000 and 2008 will seem like brief, happy corrections. It took about 25 years for the economy and market to correct the extremes of the 1920s. It took another 25 years to fully work off the (much lesser) extremes of the 1960s. The extremes of the late 1990s, which have extended into the 2000s and, now, the 2010s, are, by some measures, the most extreme in history. It should not come as a surprise, therefore, if it takes us as long, if not longer, to work them off. (Pictures are worth a thousand words, so please see the charts below...) Stock prices are extraordinarily expensive. Today's cyclically-adjusted P/E ratio is the highest price-earnings ratio in 135 years, with the brief and temporary exceptions of 1929 and 2000. Interest rates, meanwhile (red line), are basically as low as they can go.  And it's not just the cyclically-adjusted PE ratio that suggests stocks are at extreme levels. Many other historically valid measures do, too. For example, the "Buffett Indicator." Warren Buffett once said that his favorite measure of stock-market valuation was total stock market capitalization to GDP. As this chart from chartist Doug Short of Advisor Perspectives shows, the Buffett indicator is at extreme levels:  Corporate profit margins are near all-time highs, helping to support today's stock prices. Note how profit margins generally revert to (and beyond) the mean:  Stock prices are still way above trend. The black "0%" line in the chart below (also from Doug Short) shows 150 years of average performance for the S&P 500. As the chart illustrates, prices have spent decades above and below this trend line. The "disaster scenario" for stock prices would simply mean that stock prices will do what they have always done, which is follow this two-decade period of above-trend performance with a decade or two below it.  Read more: http://www.businessinsider.com/stock...#ixzz3jjAFeTDs Click here to view the whole thread at www.sammyboy.com. |

| Advert Space Available |

|

| Bookmarks |

|

|